Self-Directed Accounts

Tax-Advantaged Accounts

to Suit Your Needs

to Suit Your Needs

We understand that every investor's needs are different. To that end,

we offer a wide variety of account types to fit your financial goals.

we offer a wide variety of account types to fit your financial goals.

Plans for Individuals

Our intuitive self-directed IRAs can help you meet your financial goals.

Traditional IRA

Traditional IRAs are attractive to individuals who expect to be in a lower tax bracket during retirement, or those who prefer to defer taxes into retirement.

Roth IRA

Roth IRAs are attractive to investors who expect to be in a higher tax bracket during retirement, or those who prefer to preserve assets for later retirement years or future generations.

Inherited IRA

Inherited IRAs are established when an individual inherits an IRA or employer-sponsored retirement plan after the original owner passes away.

Self-Employed Business Plans

We offer the best self-directed IRAs for self-employed professionals.

SEP IRA

SEP IRAs may be attractive to self-employed individuals who want to save more for retirement than is allowed in Traditional and Roth IRAs or small businesses that want to offer retirement plans without incurring significant administrative costs.

Simple IRA

SIMPLE IRAs may be attractive for self-employed professionals or small businesses who want to encourage employees to save for retirement without incurring significant administrative costs associated with 401(k)’s or other types of qualified retirement plans.

Individual

401(k) Plan

401(k) Plan

A solo 401(k) is an individual 401(k) designed for a business owner with no employees. IRS rules prohibit contributions to a solo 401(k) if you have full-time employees, but you can use the plan to cover yourself and your spouse into retirement.

Custodial Account Options

Our custodial account solutions can fit virtually any need.

Accounts for Entities

Accounts designed for a variety of different financial planning purposes using qualified or non-qualified funds on behalf of a business.

Accounts for Individuals

Accounts designed for a variety of different financial planning purposes using qualified or non-qualified funds on behalf of an individual.

Trust & Escrow Accounts

Accounts that can be designed in a variety of ways to meet speci c requirements on how and when to use assets based on terms established in the agreement.

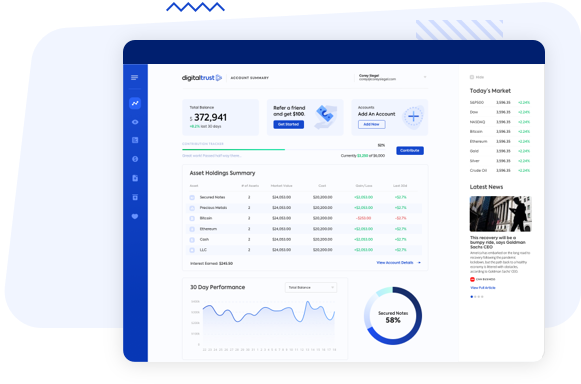

Control your retirement

all in one place.

all in one place.

Create a free account to invest for your future.